Things about Public Adjuster Nj

Table of ContentsThe Main Principles Of Public Adjuster The Best Guide To Public Adjuster NjThe smart Trick of Public Adjuster Nj That Nobody is Talking About

If you're believing of working with a public insurance adjuster: of any type of public insurance adjuster. Request suggestions from family as well as affiliates. Ensure the insurer is certified in the state where your loss has occurred, and also call the Better Company Bureau and/or your state insurance coverage division to examine up on his/her document.

Your state's insurance coverage department might establish the percentage that public adjusters are permitted fee. Public Insurance Adjuster. Watch out for public insurance adjusters that go from door-to-door after a disaster.

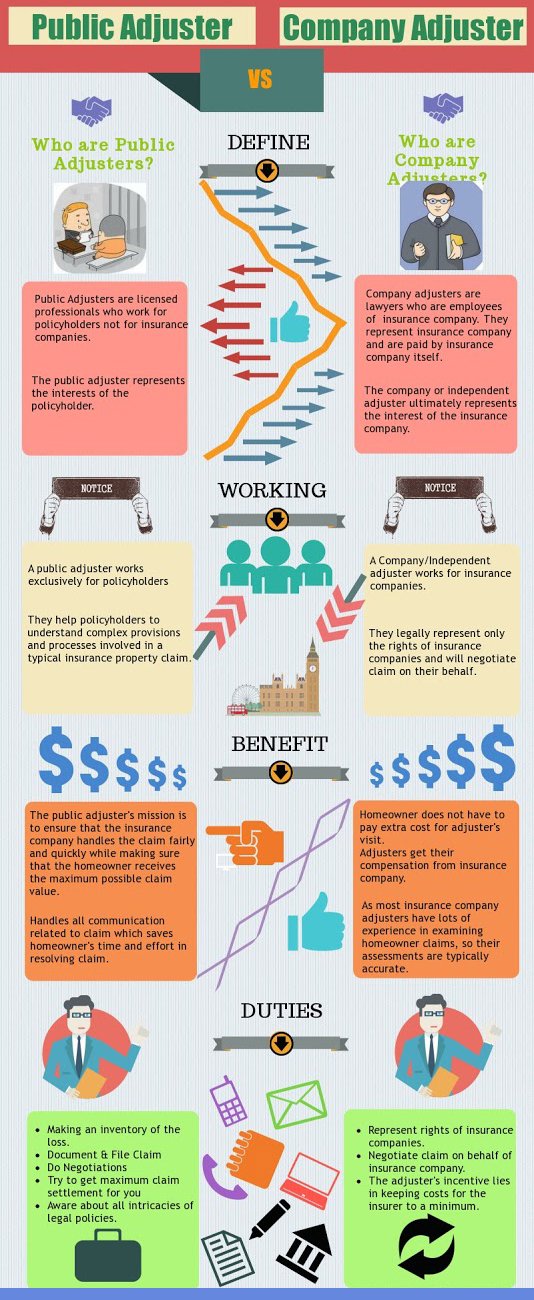

Insurance coverage adjusters are in charge of reviewing the degree of damages to a home after a case like a fire or cyclone. As well as evaluate property loss in behalf of an insurance holder as well as aid them submit insurance cases in exchange for a cost. They are licensed professionals who help people as well as companies not insurer and can conserve you a great deal of cash by ensuring your insurance firm is paying the complete amount it is accountable for under your policy.

The Greatest Guide To Public Insurance Adjuster

Public insurance adjusters are specialists in the details and also language of insurance policy policies, as well as at filing and adjusting claims. They frequently have previous experience in building and construction or one more relevant field, and use advanced software to do an independent assessment of a client's residential property loss. They understand precisely just how to log and also send first as well as supplementary claims for an insurance holder.

In the table listed below are thing descriptions, amounts and expenses pulled from an example of a property insurance claim form. It's unlikely a policyholder would be able to finish a type precisely with a see it here comparable level of detail, because every insurance claim is different. They additionally help clients negotiate with contractors and their insurer.

Public insurers are among the three primary groups of insurance insurer, and each is employed by a different group. Insurance policy business, businesses and also individuals all utilize insurance coverage insurers to review building loss as well as figure out the dollar amount an insurance claim should pay. To much better accommodate the different parties, there are 3 distinctive kinds of insurance coverage insurers: firm insurers, independent insurers and also public insurance adjusters.

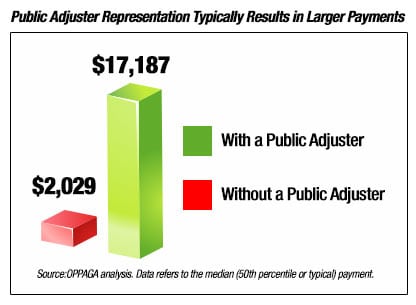

Public adjusters likewise top the dollar amount their fees can get to per insurance claim. Generally, public insurance adjusters with much less experience might top their fees at $5,000 per insurance claim. Experienced insurance adjusters could cap their costs at a lot greater quantities, such as $10,000 or $15,000. For instance, a public insurer might accumulate a charge of $15,000 for a $350,000 claim, rather why not find out more than their typical 20% fee which would certainly total up to $70,000.

The 6-Minute Rule for Public Adjuster Nj

There are a variety of points an insurance holder can do to make certain they are employing a great public insurance adjuster. The very first point they need to examine is whether the public insurer can lawfully practice. Public insurance policy adjusters must be accredited in every specific state they practice in. Like other specialists, they likewise must be bonded as well as take part in proceeding education and learning programs to maintain their licensure.

Some public change firms may send out one insurance adjuster to do an estimate and also one more to comply with up and also extensively evaluate a case. As a policyholder, you could prefer to work personally with a single insurance adjuster, but having a company send out greater than someone could not be a bad thing.